Adjustments in Neat

Adjustments FAQs

- What are Adjustments?

- What types of adjustments can I enter?

- How do I adjust or enter a starting balance?

- How do I record a depreciation or amortization?

- How do I make a category adjustment?

- Can I create a report of my adjustments?

What are Adjustments?

In general, an adjustment records a business transaction in an accounting system for an organization. Adjustments make it possible to track how a business has used its resources and where those resources came from. They can be used to correct a previous error or account for a transaction that was not already recorded.In Neat, adjustments allow you to set and adjust starting balances, record depreciation and amortization, and make adjusting entries.

What types of adjustments can I enter?

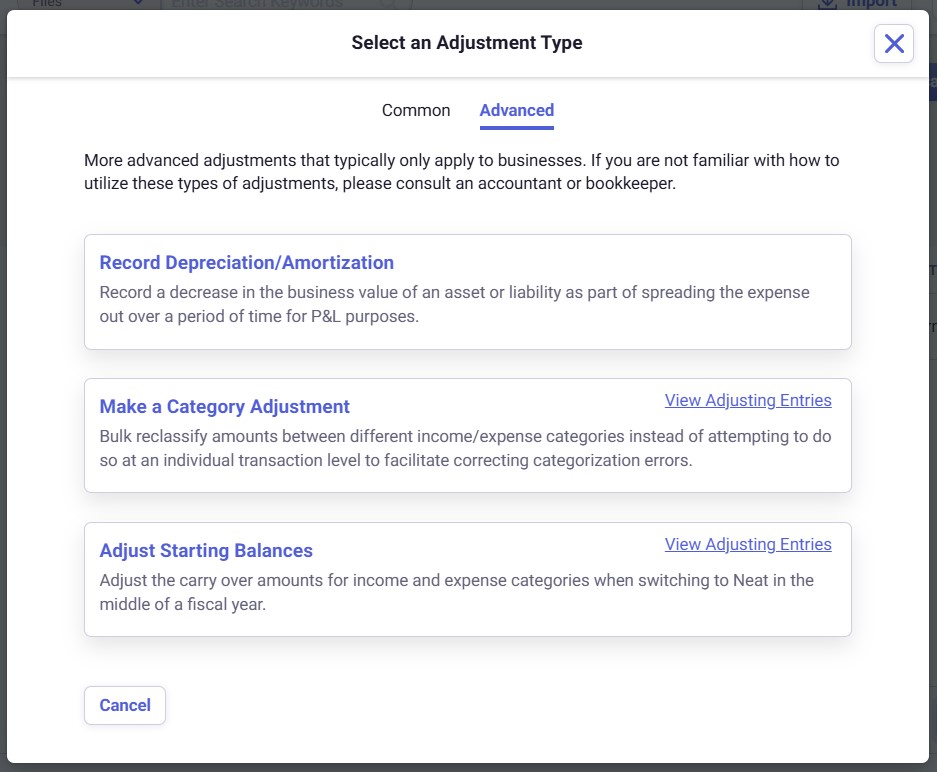

You can create several adjustments in Neat, classified as either Common (for both individuals or businesses) or Advanced (typically used by businesses).Common Adjustments

- Adjust an Asset's Current Value

- Record a change in the current value of property, vehicles, etc., that you are not depreciating or amortizing for business purposes.

- Record a Transfer of Funds Between Accounts

- Quickly record a transfer of funds between two different transactional accounts.

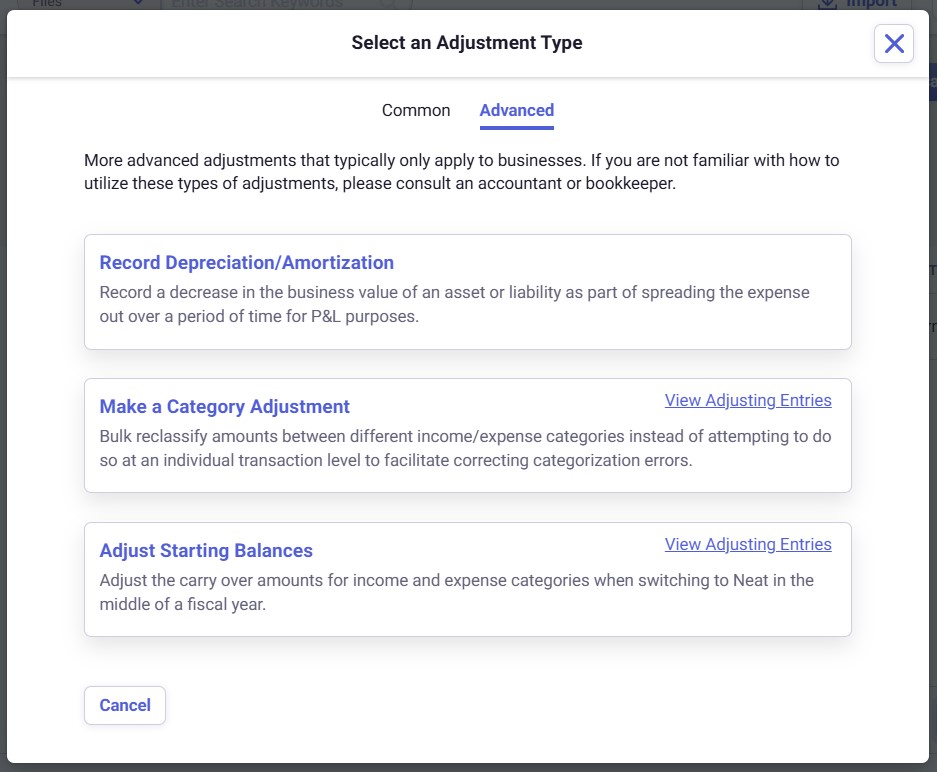

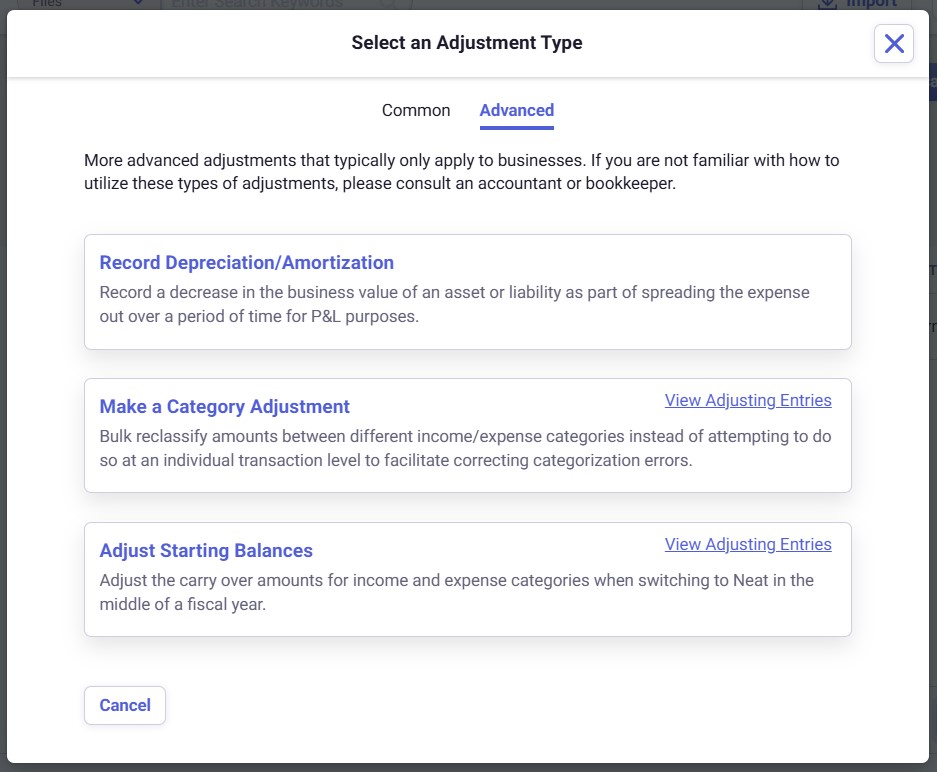

Advanced Adjustments

- Record Depreciation/Amortization

- Record a decrease in the business value of an asset or liability as part of spreading the expense out over a period of time for P&L purposes.

- Adjust Starting Balances

- Adjust the carry-over amounts for income and expense categories when switching to Neat in the middle of a fiscal year.

- Make a Category Adjustment

- Bulk reclassify amounts between different income/expense categories instead of attempting to do so at an individual transaction level to facilitate correcting categorization errors.

How do I adjust or enter a starting balance?

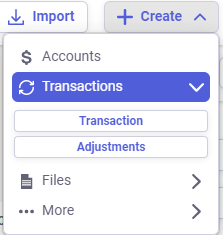

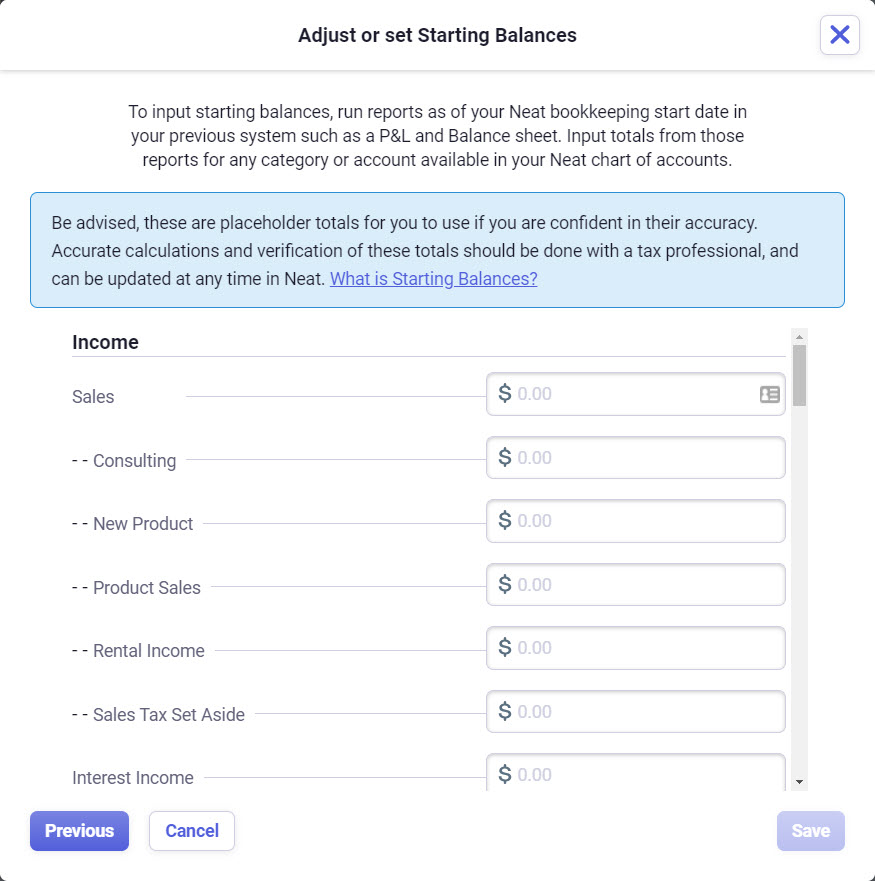

You can set or adjust your starting balance as needed. If you need to consult with your financial advisor or you need to verify your account totals, you can return later to set and adjust starting balances at any time through the Adjust or Set Starting Balances modal.- Click the + Create button in the top right corner of Neat, and in the dropdown window, click Transactions, then Adjustments.

- In the Select an Adjustment Type window, select Advanced, then click Adjust Starting Balance.

- In the Adjust or set Starting Balance window enter your starting balances and click Save when you're done.

Please Note: These are placeholder totals for you to use if you are confident in their accuracy. Accurate calculations and verification of these totals should be done with a tax professional, and can be updated at any time in Neat.

Please Note: These are placeholder totals for you to use if you are confident in their accuracy. Accurate calculations and verification of these totals should be done with a tax professional, and can be updated at any time in Neat.

How do I record a depreciation or amortization?

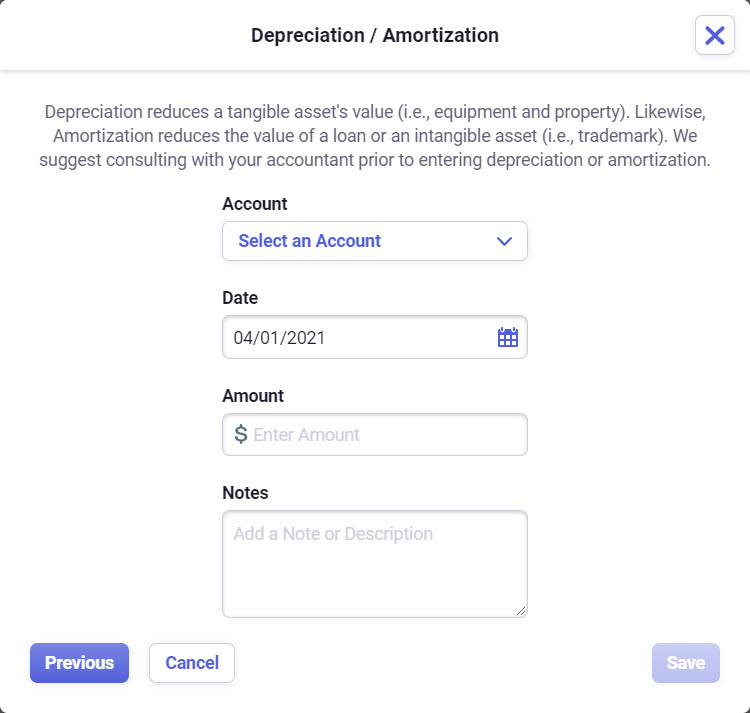

Within Neat you are able to record depreciation or amortization of an asset. When Record Depreciation or Amortization is selected, you will be required to identify the asset account, the date of when the expense was recorded, and the amount. Please follow the steps below to record depreciation or amortization of an asset in Neat. We suggest consulting with your accountant prior to entering depreciation or amortization.- Click the Add button in the top right corner of Neat, and in the dropdown window click Transactions, then Adjustments.

- Select Advanced then choose Record Depreciation or Amortization.

- In the Depreciation / Amortization window:

- From the Account drop-down, select the asset you need to adjust. This comes from your Chart of Accounts.

- Select the date. By default, the date will automatically be the current date but that can be adjusted as long as the date entered is not older than your bookkeeping start date or the opening balance transaction date for that asset account. A future date cannot be selected.

- Enter the depreciation or amortization amount. The amount must be greater than zero.

- We recommend adding a description in the notes section to help you keep track of your journal entries.

- Once all information is entered you can click Save.

Please Note: You cannot delete journal entries after they've been entered, so be careful that all the changes you made are accurate before clicking save.

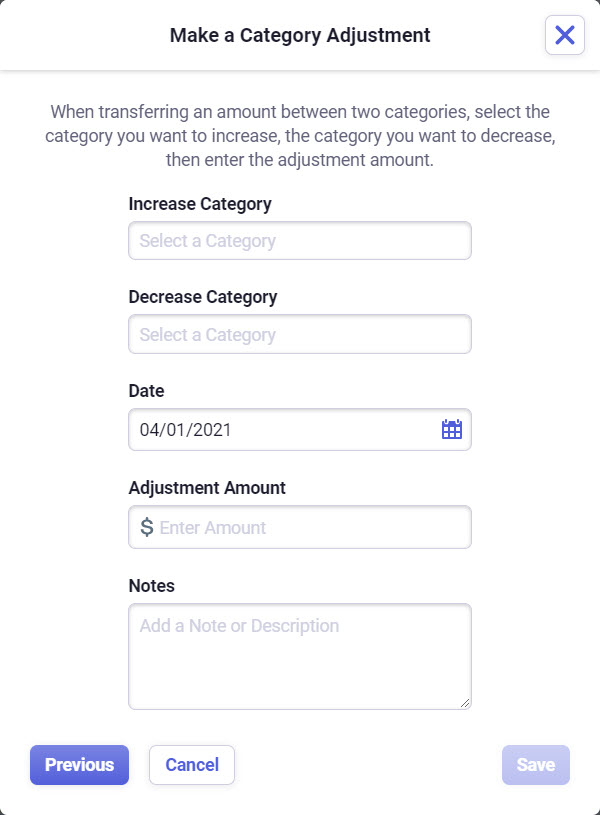

How do I make a category adjustment?

Within Neat you can also make an adjustment to a category which will provide you with the ability to adjust the totals between two or more categories/accounts. Please follow the steps below to make a category adjustment.- Click the Add button in the top right corner of Neat, and in the dropdown window click Transactions, then Adjustments.

- Select Advanced then choose Make a category adjustment.

- You will then be brought to a screen where you can fill out your custom fields for your adjusting entry.

- The Increase Category and the Decrease category allows you to choose a category from My Categories.

- Select the date. By default, the date will automatically be the current date but that can be adjusted as long as the date entered is not older than your bookkeeping start date or the opening balance transaction date for that asset account. A future date cannot be selected.

- Enter the adjustment amount. The amount must be greater than zero.

- We recommend adding a description in the notes section to help you keep track of your journal entries.

- Once all information is entered you can click Save.

Please Note: You cannot delete journal entries after they've been entered, so be careful that all the changes you made are accurate before clicking save.

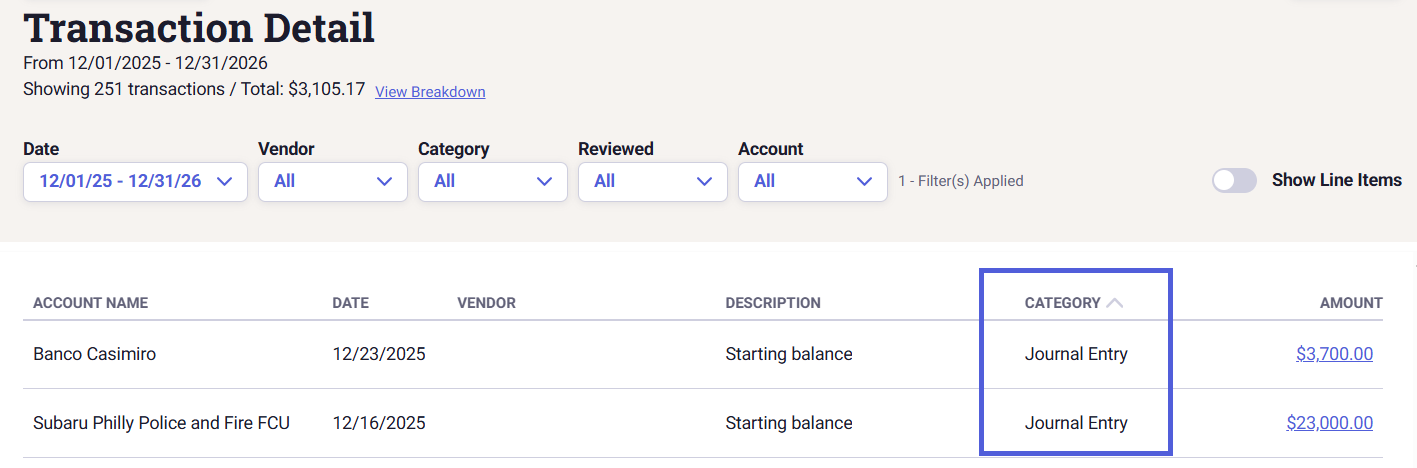

Can I create a report of my adjustments?

Currently, your adjustments will only flow through to the Transaction Detail Report.The Transaction Detail report will include all journal adjustments from manual asset and liability accounts, including:

- Depreciation and Amortization

- Balance adjustments

- Category starting balance

- Category adjustments