Spending & Tax Reporting in Neat

Spending and tax reports help you track expenses, categorize spending, and stay organized throughout the year. These reports make it easy to review where money is being spent, identify deductible expenses, and gather the information you need for tax preparation, without sorting through individual receipts or files.To learn about ALL the available reports in Neat, check out our Reporting Overview Help Center article.

Spending & Tax Reporting in Neat

- What types of spending & tax reports can I run in Neat?

- How do I create an expense report?

- How do I create a spending detail report?

- How do I create a spending summary report?

- How do I create a tax category report?

- How do I create a sales tax report?

- How do I locate my saved reports?

- My report is taking a long time to generate, is something wrong?

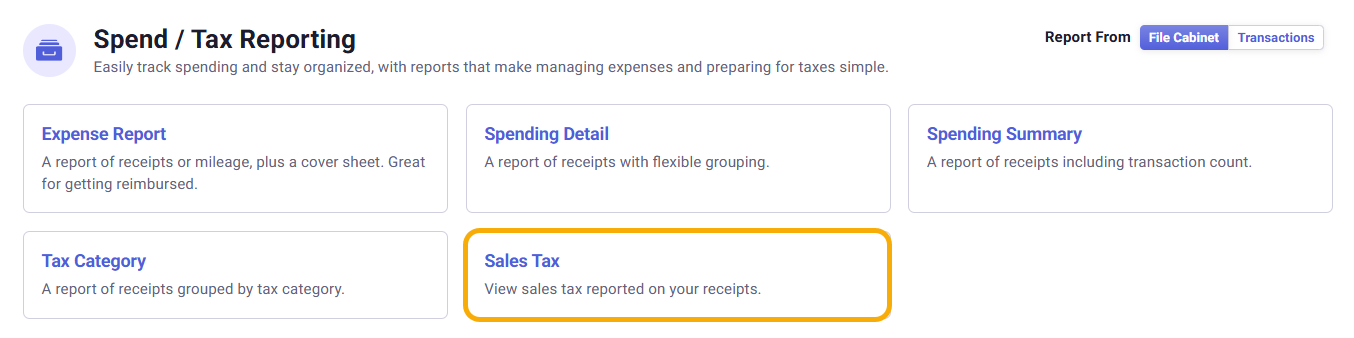

What types of spending & tax reports can I run in Neat?

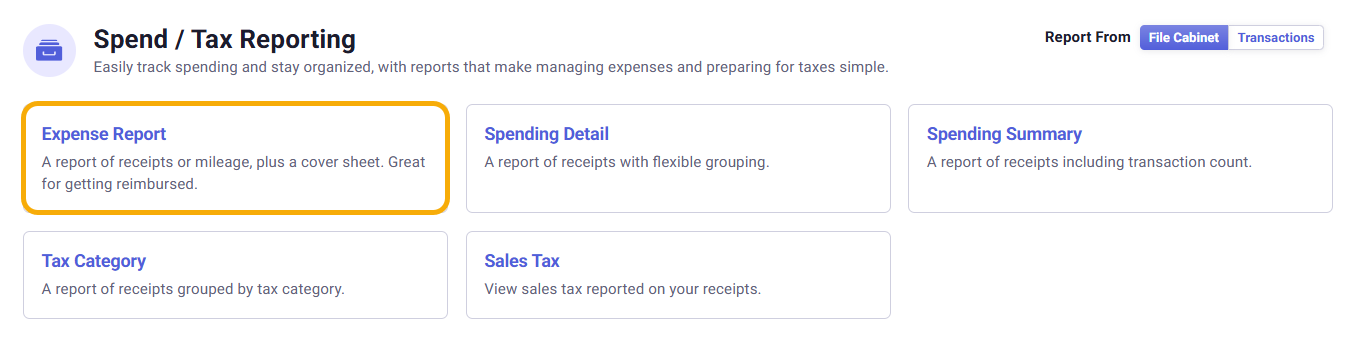

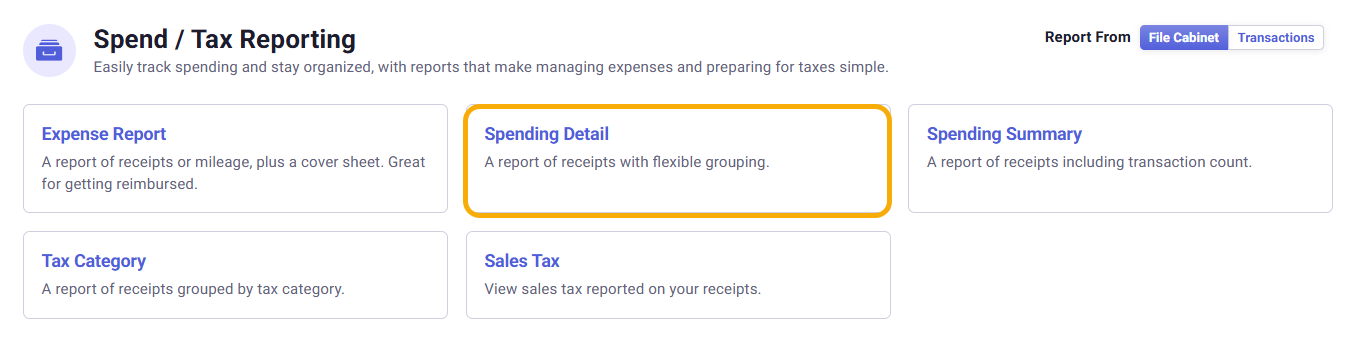

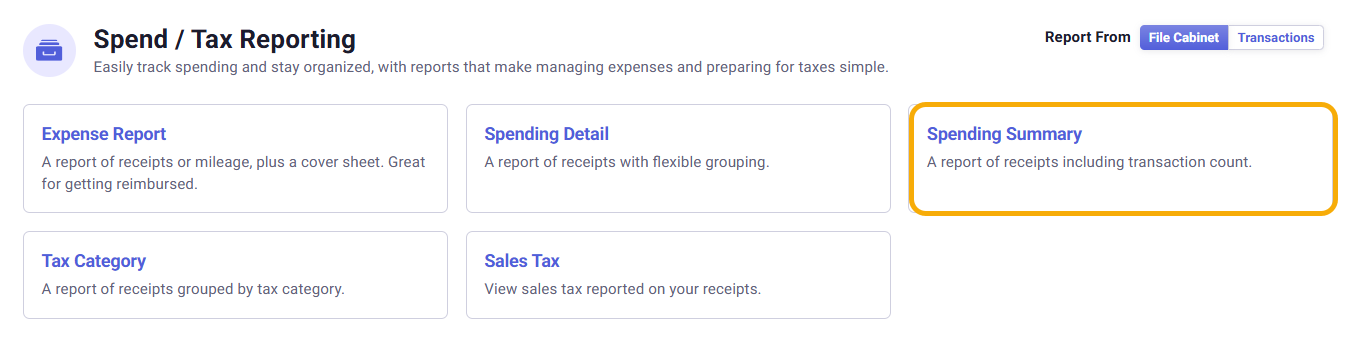

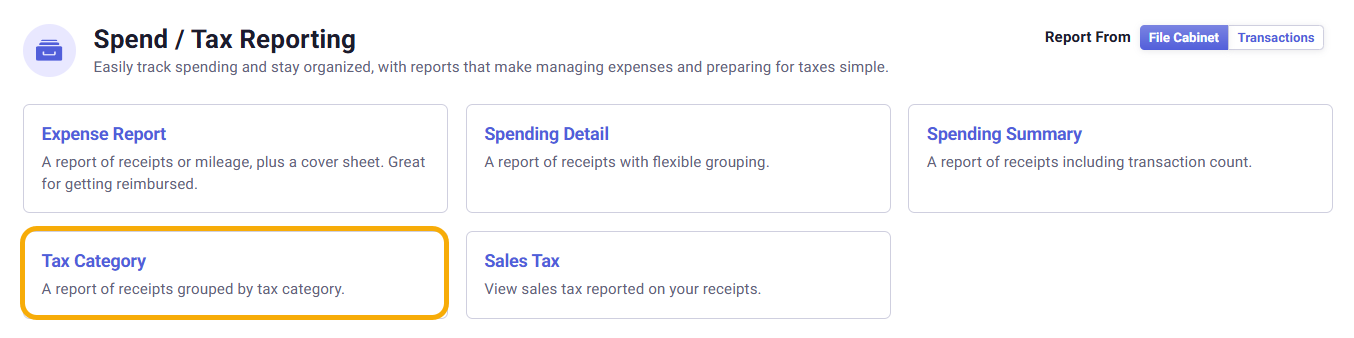

There are several available spending/tax report types you can run in Neat. ALL spending & tax reports can be run on transactions in the 'Do My Books' section and on files in the 'Organize My Files' section.Check out the list of available spending/tax reports below:

Expense Report: The Expense Report summarizes receipts, mileage, and other expenses. This report provides you with a convenient cover sheet, line-by-line breakdown of all the expenses in the report, and source images if you choose to include them. Use this report to organize your expenses, for reimbursement requests, and maintain accurate records for accounting or tax purposes.

Spending Detail: The Spending Detail report provides a comprehensive view of your receipts, with flexible grouping options to organize data by category, date, vendor, or other criteria. Use this report to analyze spending patterns, identify trends, and gain better control over your business or personal expenses. The spending detail report provides you with a subtotal for each grouping and includes the % of the subtotal amount for each item within a group. Spending detailed reports allow you to add a subtitle and additional filters to your report. You can also include images in your spending detail report and choose to see 1, 2, or even 4 images per page.

Spending Summary: The Spending Summary report provides an overview of your receipts, including the total transaction count and aggregated amounts. Use this report to quickly see overall spending, identify trends, and gain a high-level understanding of where your money is going. The spending summary report breaks down the number of expenses for each group, in addition to a subtotal for each grouping, and includes the % of the subtotal amount for each item within a group. Spending summary reports allow you to add a subtitle and additional filters to your report. You can also include images in your spending summary report and choose to see 1, 2, or even 4 images per page.

Tax Category: The Tax Category report organizes your receipts by tax category, giving you a clear view of deductible expenses and taxable items. Use this report to simplify tax preparation, ensure accurate reporting, and easily share categorized information with your accountant. The tax category report groups your items with subtotals along with a grand total of all groups and also lists the date, category, total amount, and % of total for each item. Tax category reports allow you to add a subtitle and additional filters to your report. You can also include images in your tax category report and choose to see 1, 2, or even 4 images per page.

Sales Tax: The Sales Tax report shows the sales tax collected and reported on your receipts over a specific period. Use this report to verify sales tax amounts, simplify filing, and ensure compliance with local or state tax regulations. The sales tax report reports the sales tax for selected items along with the date, category, subtotal, and % of total for each group. It concludes with a grand total of all items in the report. Sales tax reports allow you to add a subtitle and additional filters to your report. You can also include images in your sales tax report and choose to see 1, 2, or even 4 images per page.

How do I create an expense report?

An expense report will show you a detailed summary of all the expenses included in the report.- First click Reports at the top right hand corner of Neat.

- Under the Spend / Tax Reporting section, change your report settings. If you are creating a report for transactions in the 'Do My Books' section, toggle your report settings to Transactions. If you are creating a report for files in the 'Organize My Files' section, toggle your report settings to File Cabinet.

- Under the Spend / Tax Reporting section click Expense Report to begin creating your report.

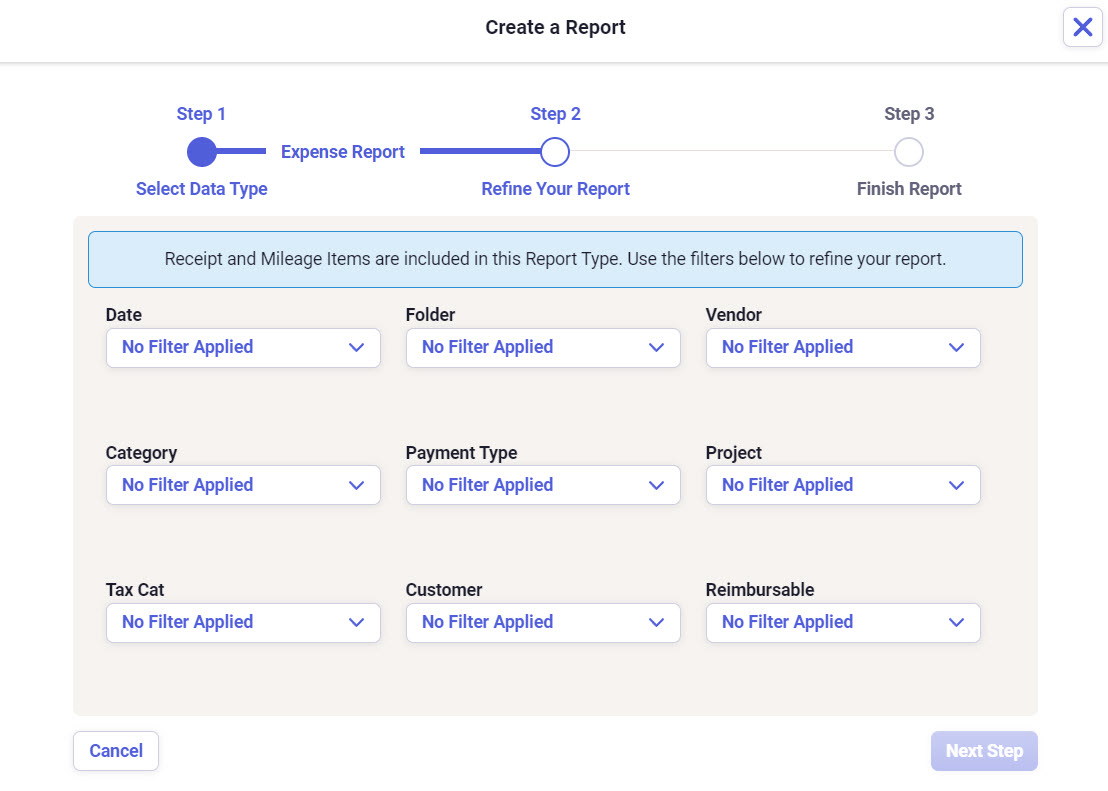

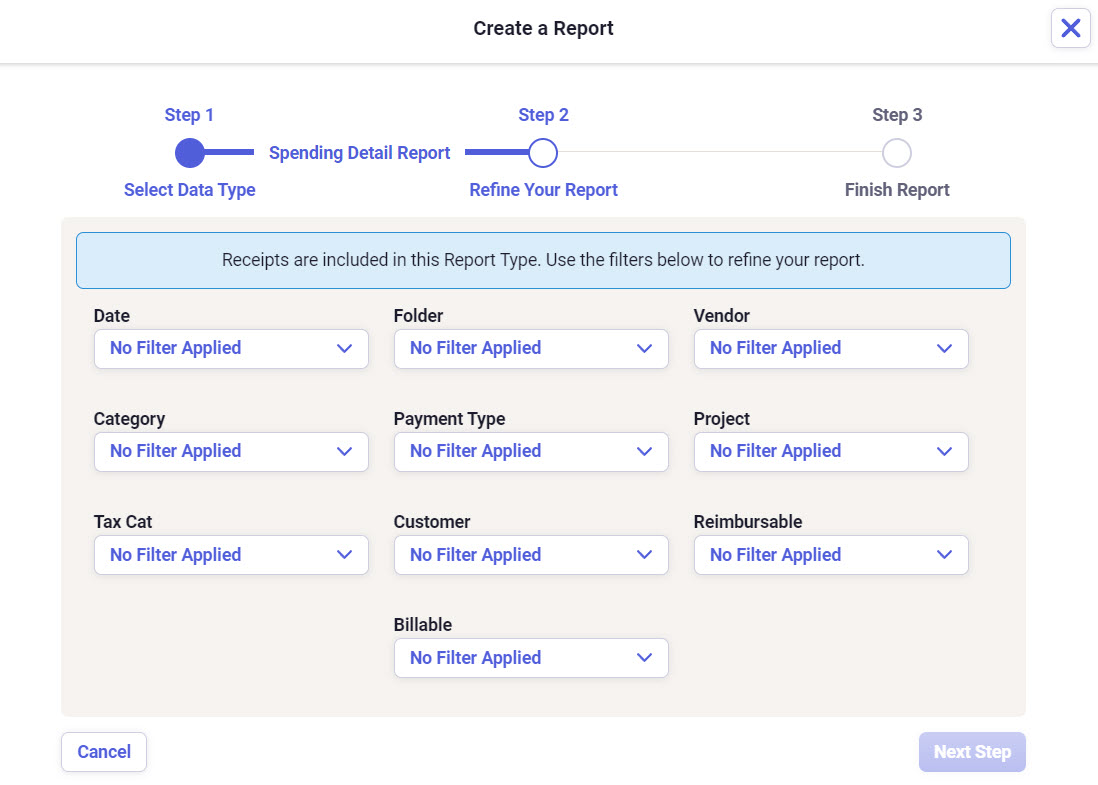

- The next window will allow you to set filters to refine your report.

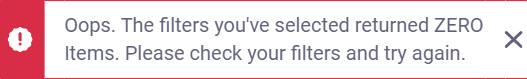

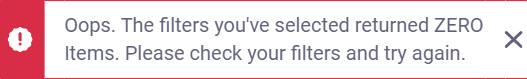

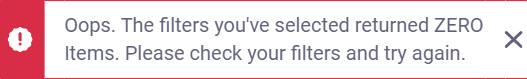

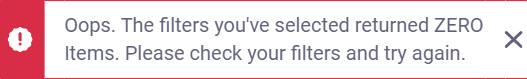

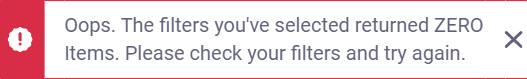

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

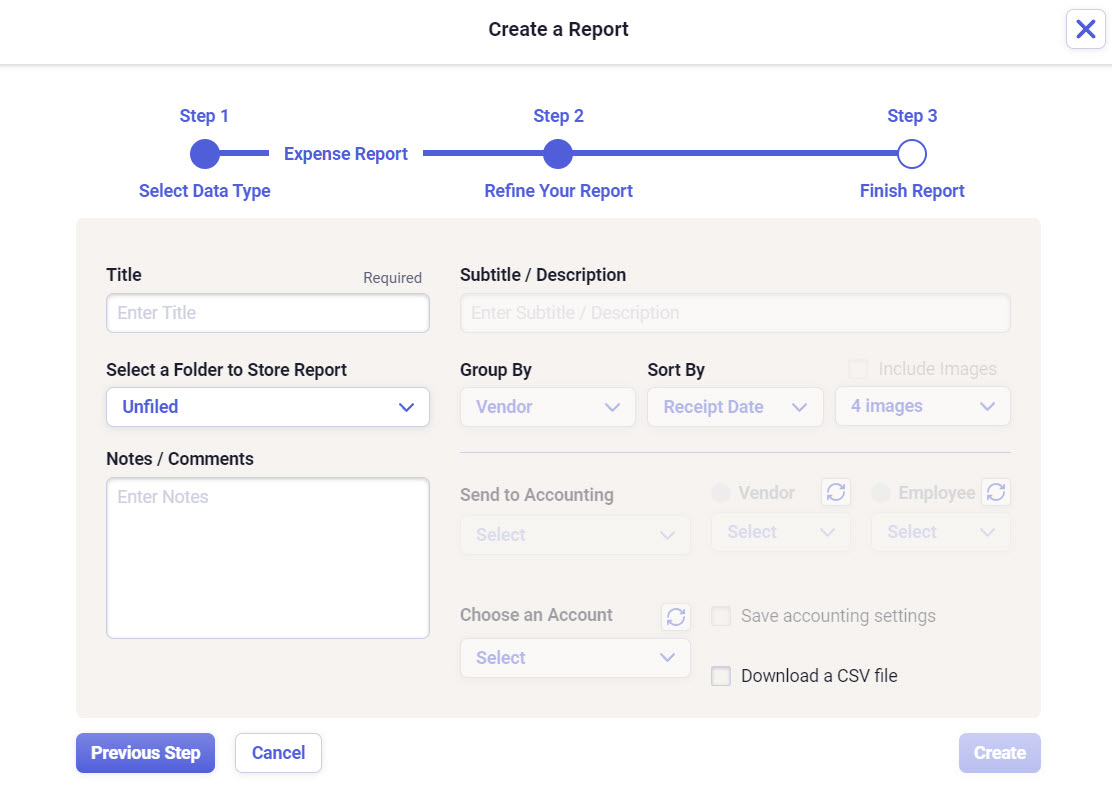

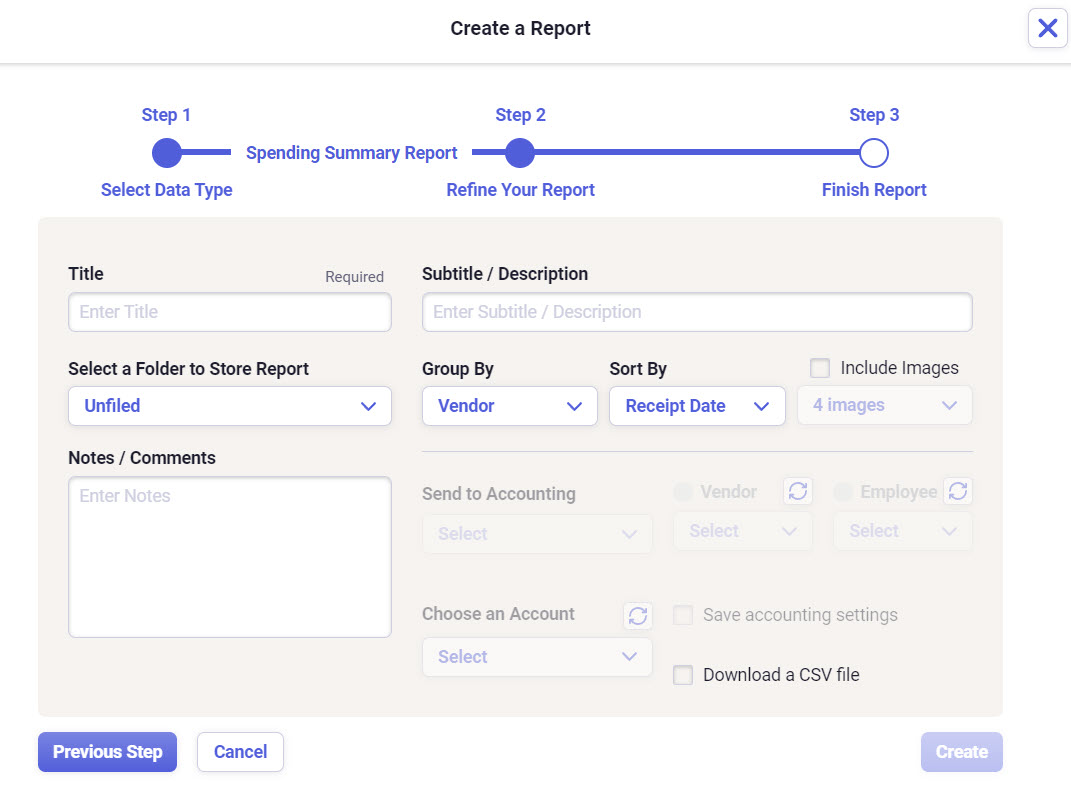

- Once you have your filters set, you can click Next Step to finish out your report. Here you can add a Title (a required field), description of your report, notes and comments, select a folder to store your report. You can also group, sort and include images in your report.

- Once you finish adding your final touches to the report, click Create in the bottom right corner then your report will be generated and can be accessed in your Saved Reports folder in your File Cabinet.

How do I create a spending detail report?

A spending detail report will organize the purchases included in the report by group. It will provide subtotals for each group you selected (vendor, expense category, payment type, client, or project) as well as provide a grand total of all items.- Click on Reports in the top right hand corner of Neat.

- Under the Spend / Tax Reporting section, change your report settings. If you are creating a report for transactions in the 'Do My Books' section, toggle your report settings to Transactions. If you are creating a report for files in the 'Organize My Files' section, toggle your report settings to File Cabinet.

- Under the Spend / Tax Reporting section click Spending Detail to begin creating your report.

- The next window will allow you to set filters to refine your report.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

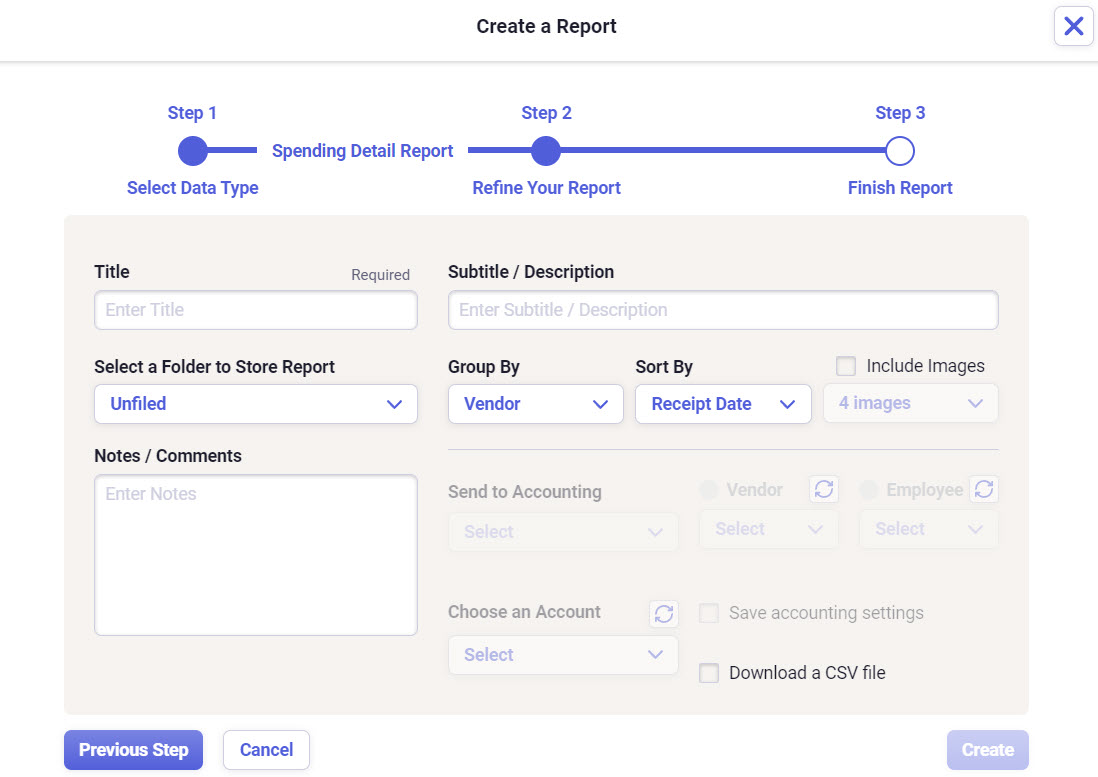

- Once you have your filters set, you can click Next Step to finish out your report. Here you can add a Title (a required field), description of your report, notes and comments, select a folder to store your report. You can also group, sort and include images in your report.

- Once you finish adding your final touches to the report, click Create in the bottom right corner then your report will be generated and can be accessed in your Saved Reports folder in your File Cabinet.

How do I create a spending summary report?

A spending summary report provides an overview of your expenses by the grouping you select. Choose from vendor, expense category, payment type, client, or project. This report includes subtotals for each group as well as a grand total of all items included in the report.- Click on Reports in the top right hand corner of Neat.

- Under the Spend / Tax Reporting section, change your report settings. If you are creating a report for transactions in the 'Do My Books' section, toggle your report settings to Transactions. If you are creating a report for files in the 'Organize My Files' section, toggle your report settings to File Cabinet.

- Under the Spend / Tax Reporting section click Spending Summary to begin creating your report.

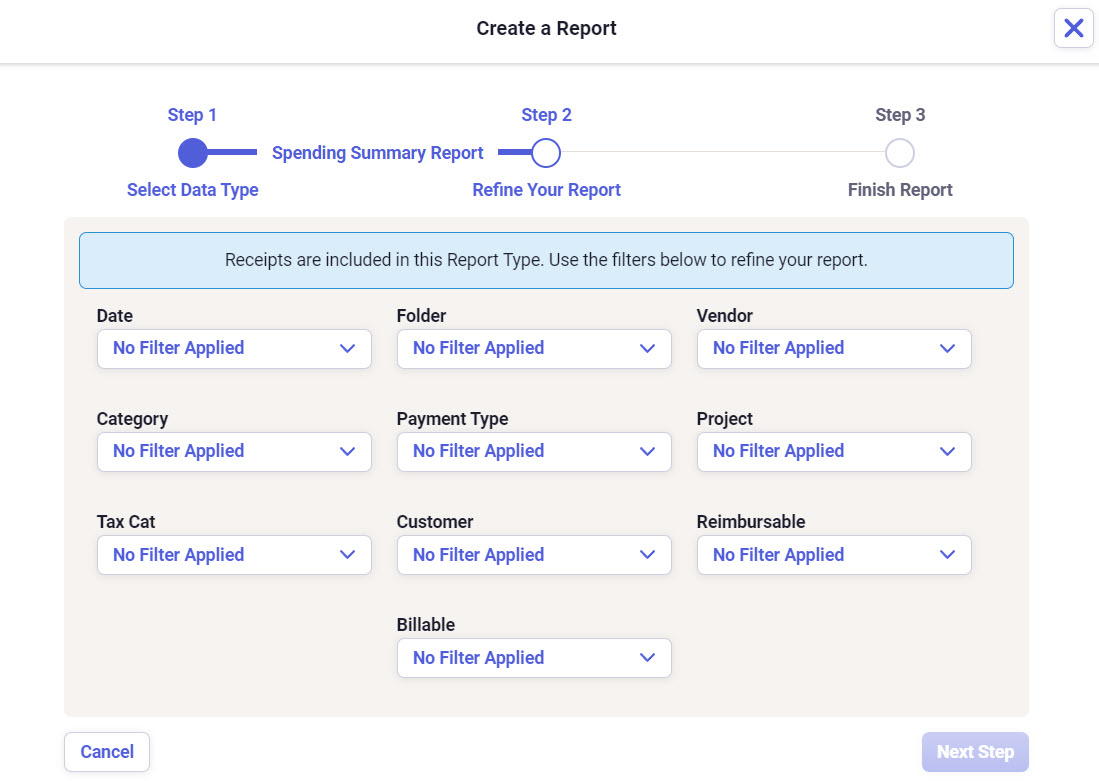

- The next window will allow you to set filters to refine your report.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

- Once you have your filters set, you can click Next Step to finish out your report. Here you can add a Title (a required field), description of your report, notes and comments, select a folder to store your report. You can also group, sort and include images in your report.

- Once you finish adding your final touches to the report, click Create in the bottom right corner then your report will be generated and can be accessed in your Saved Reports folder in your File Cabinet.

How do I create a tax category report?

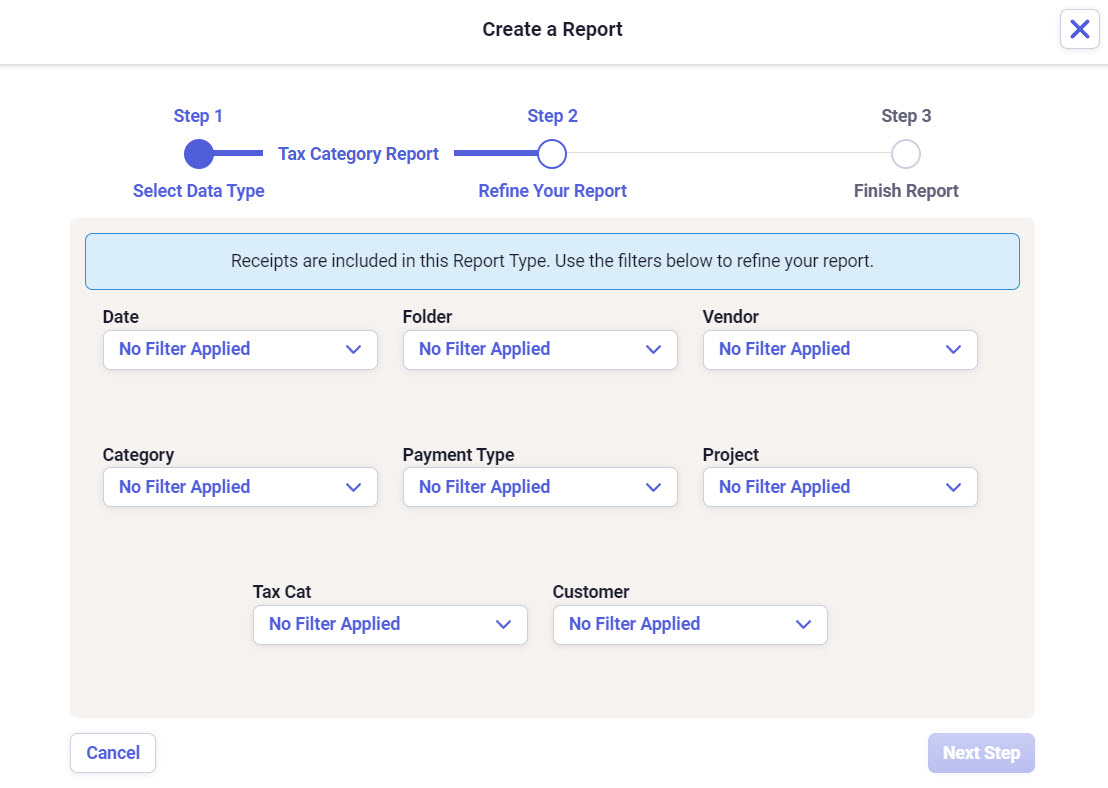

A tax category report will organize your items by your selected tax categories and provide subtotals for each category as well as a grand total of all items included in the report.- Click on Reports in the top right hand corner of Neat.

- Under the Spend / Tax Reporting section, change your report settings. If you are creating a report for transactions in the 'Do My Books' section, toggle your report settings to Transactions. If you are creating a report for files in the 'Organize My Files' section, toggle your report settings to File Cabinet.

- Under the Spend / Tax Reporting section click Tax Category to begin creating your report.

- The next window will allow you to set filters to refine your report.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

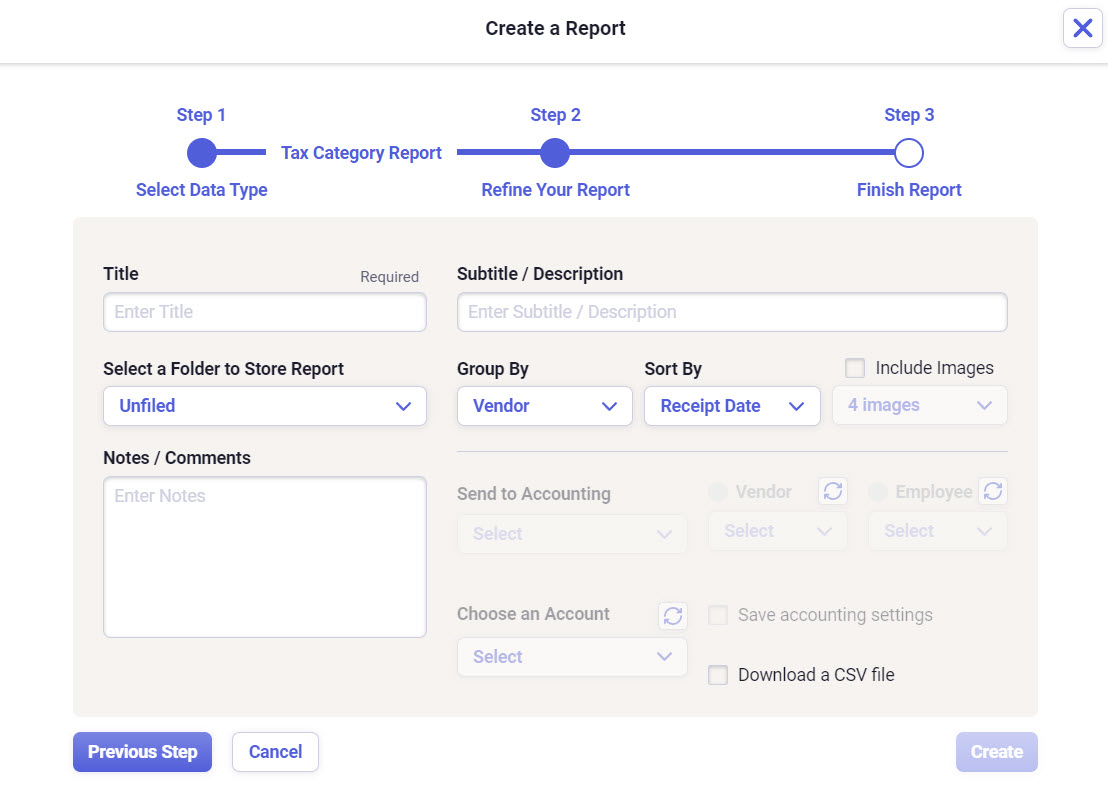

- Once you have your filters set, you can click Next Step to finish out your report. Here you can add a Title (a required field), description of your report, notes and comments, select a folder to store your report. You can also group, sort and include images in your report.

- Once you finish adding your final touches to the report, click Create in the bottom right corner then your report will be generated and can be accessed in your Saved Reports folder in your File Cabinet.

How do I create a sales tax report?

A sales tax report will itemize the sales tax you paid on items included in the report. It will provide subtotals for each group you selected (vendor, expense category, payment type, client, or project) as well as provide a grand total of all items.- Click on Reports in the top right hand corner of Neat.

- Under the Spend / Tax Reporting section, change your report settings. If you are creating a report for transactions in the 'Do My Books' section, toggle your report settings to Transactions. If you are creating a report for files in the 'Organize My Files' section, toggle your report settings to File Cabinet.

- Under the Spend / Tax Reporting section click Sales Tax to begin creating your report.

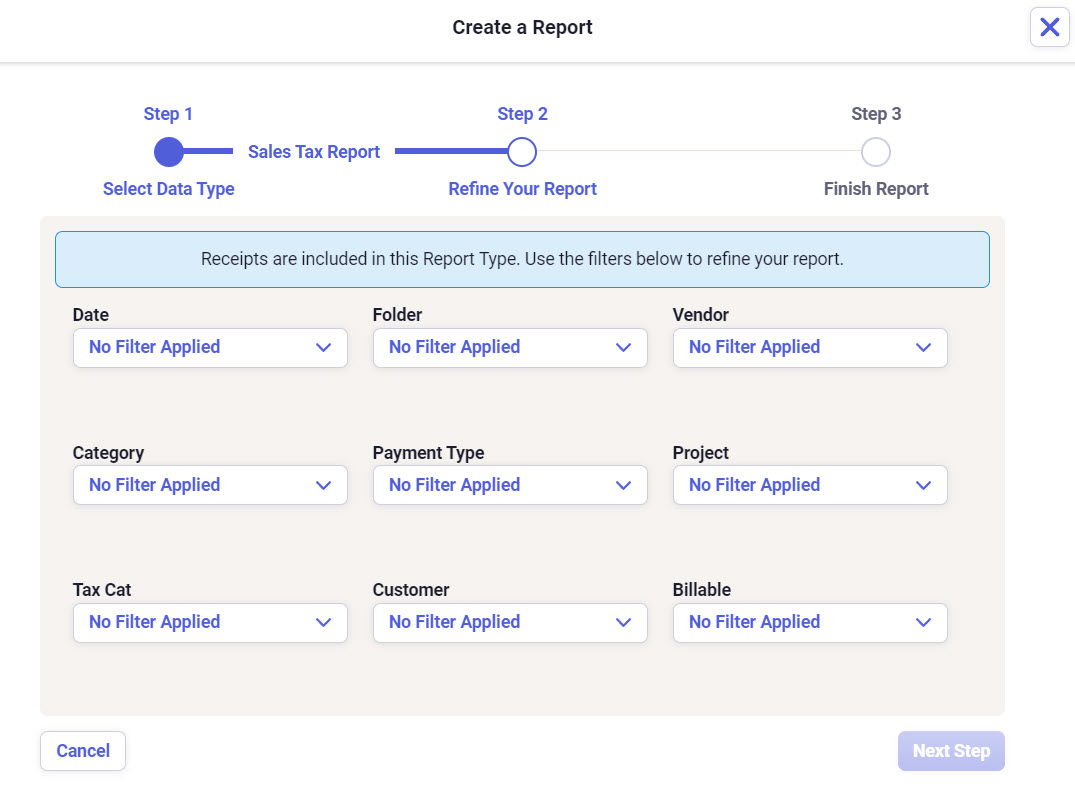

- The next window will allow you to set filters to refine your report.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

Please Note: If you receive the message Oops. The filters you've selected returned ZERO Items, then please check your filters and try again.

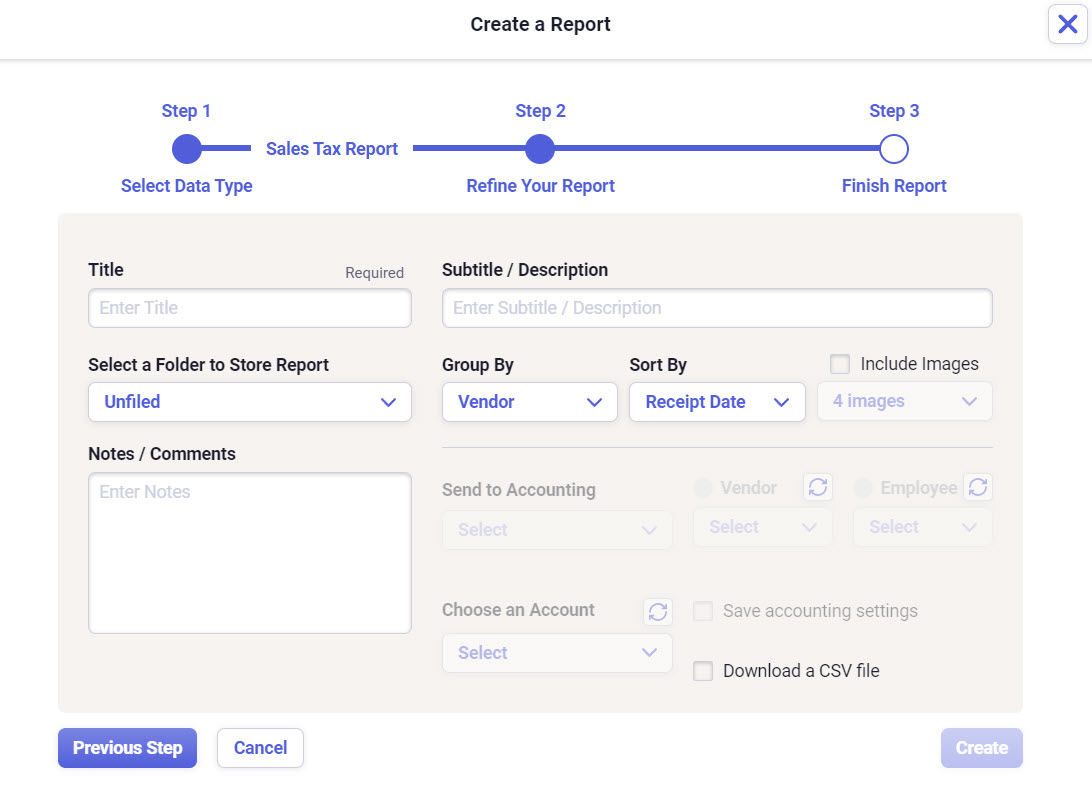

- Once you have your filters set, you can click Next Step to finish out your report. Here you can add a Title (a required field), description of your report, notes and comments, select a folder to store your report. You can also group, sort and include images in your report.

- Once you finish adding your final touches to the report, click Create in the bottom right corner then your report will be generated and can be accessed in your Saved Reports folder in your File Cabinet.

How do I locate my saved reports?

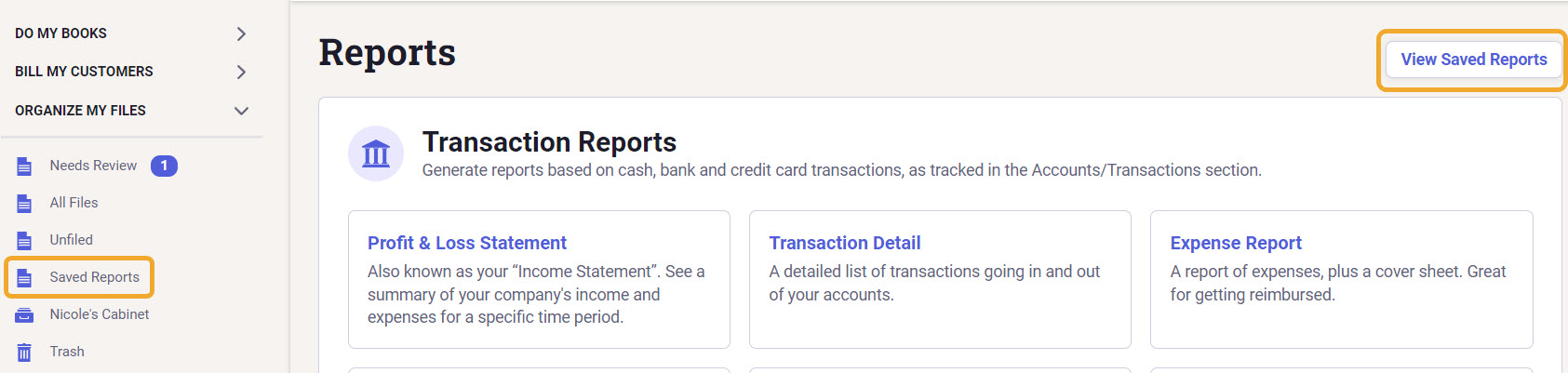

- Click on Reports in the top right hand corner. Then Click View Saved Reports.

- You can also check your reports from the Saved Reports folder in your file cabinet.

- You will then see a screen with all of your saved reports in Neat.