Meeting Electronic Document Requirements for the IRS

Yes, the IRS does accept digital receipts. IRS Rev. Proc. 97-22 says that you can prepare and transfer documents to the IRS by digitizing paper documents to an electronic storage medium that lets the IRS view them without using the software application that created them. The Neat® Company's products meet these IRS requirements through their export-to-PDF features. To read IRS Rev. Proc. 97-22, download Internal Revenue Bulletin 1997-13, and see the middle column of page 9 under the heading Rev. Proc. 97–22 SECTION 1. PURPOSE.What the IRS Requires for Digital Receipt Storage

The IRS allows taxpayers to store receipts and other tax records electronically, as long as the digital copies are accurate, readable, and retrievable. Scanned or photographed receipts are acceptable substitutes for paper originals when they meet these standards. Digital storage can be more secure and reliable than paper when files are backed up, protected, and searchable. Unlike paper receipts that can fade, tear, or be lost, properly stored digital receipts remain accessible and audit-ready for years.How long does the IRS recommend keeping receipts?

The IRS recommends keeping receipts and supporting documents for different lengths of time depending on the situation:

- The general rule for most tax records is to keep them for at least 3 years after filing a tax return

- 6 years if you underreported income by more than 25%

- 7 years for records related to bad debts or worthless securities

What Information the IRS Requires

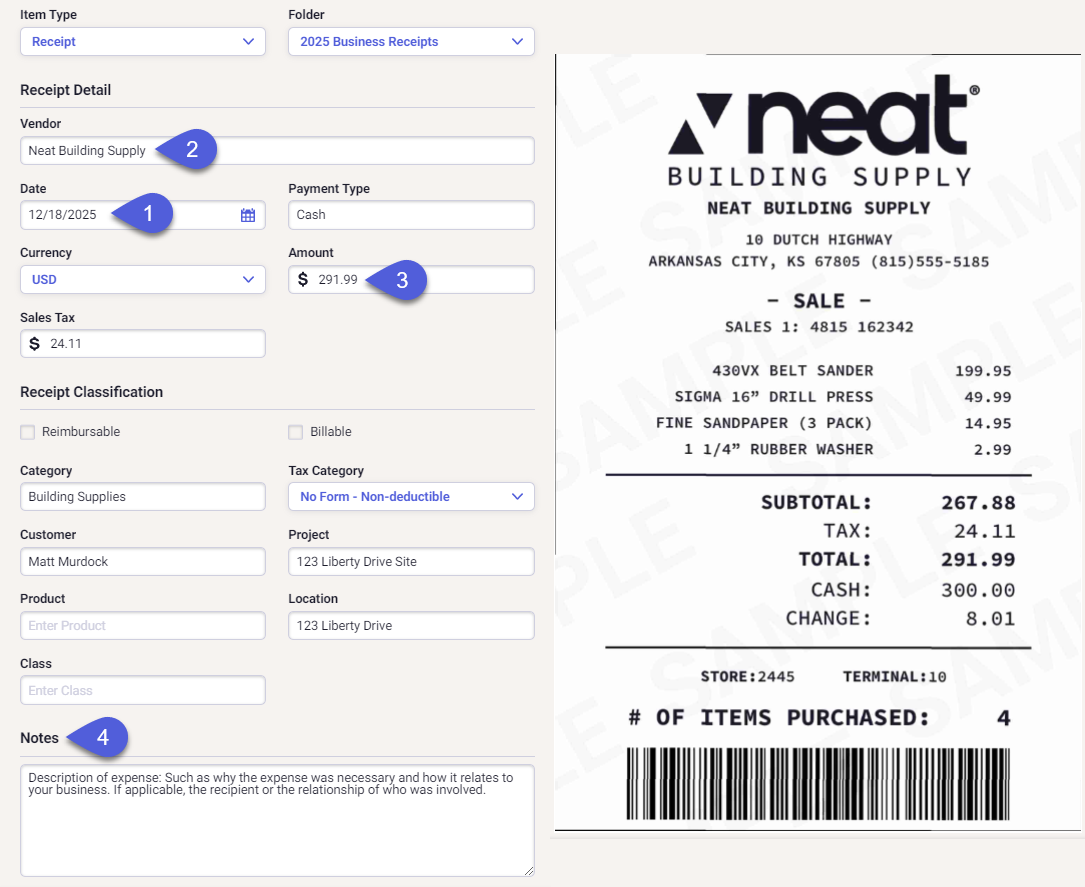

For a digital receipt to be valid for tax purposes, it should clearly include:

- Date of purchase

- Vendor or merchant name

- Amount paid

- Description of expense: Such as why the expense was necessary and how it relates to your business. If applicable, the recipient or the relationship of who was involved.